Not known Details About What Happens If I Leave a Creditor Off My Bankruptcy

Rather than acquiring various charge card expenditures and various accounts to pay for, typically with exceptionally substantial curiosity premiums, personal debt consolidation lowers Individuals specific debts into just one payment each and every month.

That alone can be a major worry reduction. You also get a chance to do a financial "reset" - While a unpleasant just one. That would assist You begin receiving your monetary lifetime back again in order.

Whether or not you can qualify to own your personal debt worn out inside of a Chapter seven bankruptcy, or be needed to enter right into a Chapter thirteen repayment program, relies on how much cash you make.

Nonetheless, it will never take the lien from the assets—the creditor can still Get better the collateral. Such as, for those who file for Chapter seven, you could wipe out a home home loan. However the lender's lien will stay on the home. If your home finance loan continues to be unpaid, the lender can exercising its lien legal rights to foreclose on your home after the automatic continue to be lifts. Study judgment liens and various liens in bankruptcy.

Creditors anticipate things to generally be good, plus the legislation ensures this happens by dividing obtainable money according to the bankruptcy payment precedence program rules when there's dollars for being experienced.

Allmand Legislation produced the whole process of getting as a result of chapter 13 bankruptcy much, much easier. They were usually beneficial and conscious of explanation my thoughts and manufactured sure I recognized what to count on alongside the best way.

We are on the lookout for legal professional matches look at these guys in your area. Make sure you notify us how they could get in contact to get a session. There was a dilemma Together with the submission. You should refresh the site and take a fantastic read a look at yet again

Viewpoints expressed Listed below are writer's by itself, not those of any lender, credit card issuer or other organization, and also have not been reviewed, accredited or usually endorsed by any of these entities, Unless of course sponsorship is explicitly indicated.

We enjoy the comprehensive data provided on Each and every lending lover, with thousands of customer reviews to aid select which a person is the only option for a personal bank loan. LendingTree has an awesome track record which is a dependable alternative if you want to utilize a referral assistance to study and protected a bank loan.

They use a complicated synthetic intelligence system that looks past just your credit score historical past - making it additional possible that you simply'll be accepted on your financial loan. Delighted buyers commonly acquire their money in a short time, and praise this service for being simple and inexpensive.

Jacqueline at Allmand Regulation is the very best - warm, compassionate and Experienced. She walked me by the this hyperlink method smoothly and wholly and her expertise was enormously appreciated.

Chapter thirteen. It's a lot easier to qualify for Chapter thirteen than for Chapter 7. As opposed to erasing your financial debt, this kind of filing reorganizes your spending. You'll reach maintain your assets, but the court docket will buy a funds so that you can survive, that will include a every month payment system on your debts.

It need to. One among the largest black marks in your credit rating rating is owning late or skipped payments, and consolidating all of find more info your current financial debt into one every month payment causes it to be additional probable you'll pay out by the due date.

Just like other credit score report facts, you can't clear away a bankruptcy from your credit history report if the information is accurate.

Jonathan Taylor Thomas Then & Now!

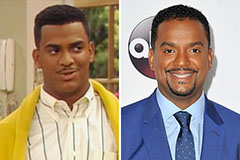

Jonathan Taylor Thomas Then & Now! Alfonso Ribeiro Then & Now!

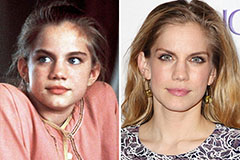

Alfonso Ribeiro Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Shane West Then & Now!

Shane West Then & Now!